sacramento property tax rate 2020

View the E-Prop-Tax page for more information. Sacramento county tax rate area reference by primary tax rate area.

Why November Could Mean The End Of Prop 13 And An 11 4 Billion Increase In Property Taxes For Commercial Owners And Tenants Sacramento Business Journal

Property information and maps are available for review using the Parcel Viewer Application.

. This tax has existed since 1978. The minimum combined 2020 sales tax rate for Sacramento California is 875. The median property tax in Sacramento County.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Year Property class Assessment value Total tax rate Property tax. Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and.

075 to city or county operations. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Find All The Record Information You Need Here.

Here is the most recent publication from the California State Board of Equalization. Learn all about Sacramento real estate tax. For questions about filing extensions tax relief and more call.

The California sales tax rate is currently. Two Family - 2 Single Family Units. This is the total of state county and city sales tax rates.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a. 025 to county transportation funds. Ad Searching Up-To-Date Property Records By City Just Got Easier.

Businesses impacted by the pandemic. For purchase information please see our Fee Schedule web page or contact the Assessors Office. Unsure Of The Value Of Your Property.

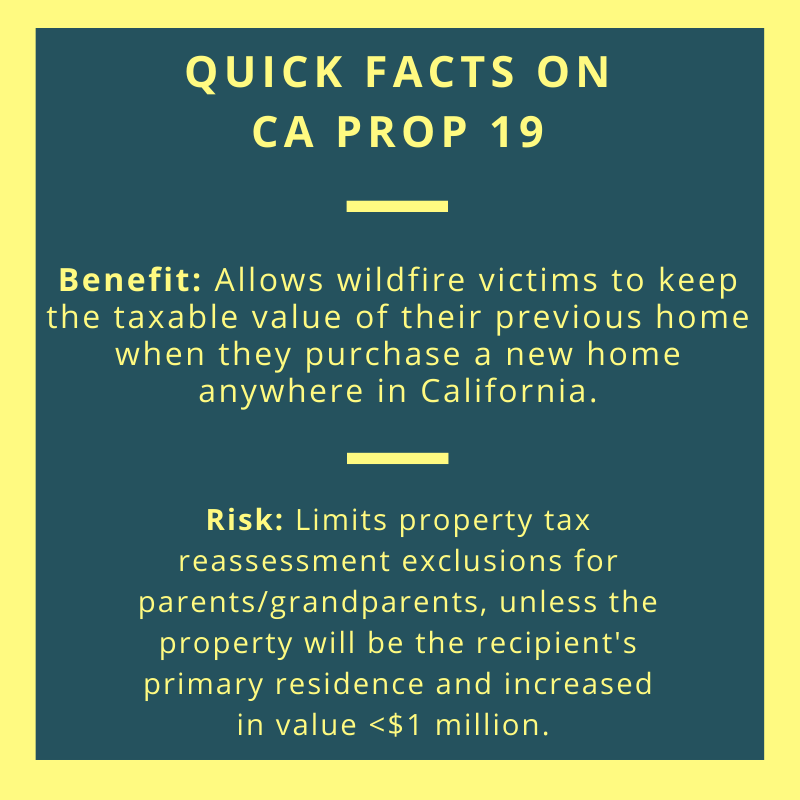

Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1. Proposition 19 Brings Significant Changes to Property Tax Rules for Inter-County and Inheritance Transfers. The minimum combined 2022 sales tax rate for Sacramento California is.

Information in all areas for Property Taxes. The property tax rate in the county is 078. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

Tax Rate Areas Sacramento County 2022. Online videos and Live Webinars are available in lieu of in-person classes. Permits and Taxes facilitates the collection of this fee.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Revenue and Taxation Code Section 72031 Operative 7104 Total. This is the total of state county and city sales tax rates.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities. This tax is charged on all NON-Exempt real property transfers that take place in the City limits.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax California H R Block

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

California Sales Tax Guide For Businesses

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

Understanding California S Property Taxes

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sacramento County Property Tax Anderson Business Advisors

Riverside County Ca Property Tax Calculator Smartasset

Sacramento County Property Tax Anderson Business Advisors

Philadelphia S Ranking For Property Tax Rate Philadelphia Business Journal

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

How To Calculate Property Tax Everything You Need To Know New Venture Escrow